south san francisco sales tax rate 2020

San Francisco CA Sales Tax Rate. Ad Lookup Sales Tax Rates For Free.

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

What is the sales tax rate in South San Francisco California.

. Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. These rates are weighted by population to compute an average local tax rate. Year Calexico CA Housing Market 20 SALES OR USE TAX PAID TO OTHER STATES Enter the amount of tax paid for merchandise purchased City of Calexico Eff.

Presidio of Monterey Monterey 9250. Please ensure the address information you input is the address you intended. The tax rate given here will reflect the current rate of tax for the address that you enter.

B Three states levy mandatory statewide local add-on sales taxes at the state level. City of San Mateo 9625 City of South San Francisco 9875 SANTA BARBARA COUNTY 775 City of Carpinteria 900 City of Guadalupe 875. California requires S corporations to pay a 15 franchise tax on income with a minimum tax of 800.

The minimum combined 2022 sales tax rate for South San Francisco California is. Collection Procedures for Transient. Filing Requirements from the CA Franchise Tax Board.

The San Francisco Bay Ferry is administered by the Water Emergency Transportation Authority. SALES AND USE TAX RATES CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION California Sales and Use Tax Rates by County and City Operative April 1 2022 includes state county local and district taxes. Those district tax rates range from 010 to 100What is the sales tax in California 20217252021 Local Sales Tax RatesA Presidio San Francisco Sales Tax Calculator For 2021 December 28 2021 at 430 am.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. The California sales tax rate is currently. Interactive Tax Map Unlimited Use.

The County sales tax rate is. Offering the property at public auction allows the collection of past due taxes. Otherwise you will owe the annual tax rate of 884 and must file Form 100 California Franchise or Income Tax Return.

For tax rates in other cities see. The South San Francisco California sales tax is 925 consisting of 600 California state sales tax and 325 South San Francisco local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 250 special district sales tax used to fund transportation districts local attractions etc. CHICO The city of Chico is proposing a ballot measure set for the November 2022 election that would raise the local sales tax by.

The December 2020 total local sales tax rate was 9750. The South San Francisco sales tax rate is. The South San Francisco California sales tax is 750 the same as the California state sales tax.

State Local Sales Tax Rates As of January 1 2020. Principal Interest 342707. Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below.

Tax returns are required monthly for all hotels and motels operating in the city. 850 Is this data incorrect The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. In light of the COVID-19 public health crisis and shelter-in-place orders in effect in San Francisco the sale scheduled for May 1 2020.

The current Transient Occupancy Tax rate is 14. Sales tax rate differentials can induce consumers to shop across borders or buy products online. 1788 rows California City County Sales Use Tax Rates effective April 1 2022.

The current total local sales tax rate in San Francisco CA is 8625. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. South San Francisco CA Sales Tax Rate.

Monthly Costs For 3663 Erris Court South San Francisco CA 94080. The primary purpose of a tax sale is to collect taxes that have not been paid by the property owner for at least five years. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

The South San Francisco Sales Tax is collected by the merchant on all qualifying sales made within South San Francisco. The current total local sales tax rate in South San Francisco CA is 9875. The current total local sales tax rate in South San Francisco CA is 9875.

While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. The South San Francisco California Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in South San Francisco California in the USA using average Sales Tax Rates andor specific Tax Rates by locality within South San Francisco California. This is the total of state county and city sales tax rates.

The December 2020 total local sales tax. California 1 Utah 125 and Virginia 1. South San Francisco 9875.

There is no applicable city tax. Its sales tax from 595 percent to 61 percent in April 2019. You can print a 9875 sales tax table here.

Gross receipts tax gr proposition f was approved by san francisco voters on november 2 2020 and became effective january 1 2021. South Shore Alameda 10750. 5 digit Zip Code is required.

Did South Dakota v. For tax rates in other cities see. The December 2020 total local sales tax rate was 9750.

2 days ago Income Taxes. The December 2020 total. A City county and municipal rates vary.

Type an address above and click Search to find the sales and use tax rate for that location. A yes vote was a vote in favor of increasing the local hotel tax incrementally from 10 percent to 14 percent in 2021 with funds used for general city purposes. South San Francisco Sales Tax Rate 2021.

The current Conference Center Tax is 250 per room night. Sales Tax Rate in Mexico remained unchanged at 16 percent in 2021 from 16 percent in 2020. Maintenance Common Charges 275.

279 Holly Ave SOUTH SAN FRANCISCO CA 94080 1499000 MLS ML81885585 2000SF liveable.

California Sales Tax Rates By City County 2022

California Sales Tax Small Business Guide Truic

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

List These California Cities Will See A Sales Tax Hike On July 1 Kron4

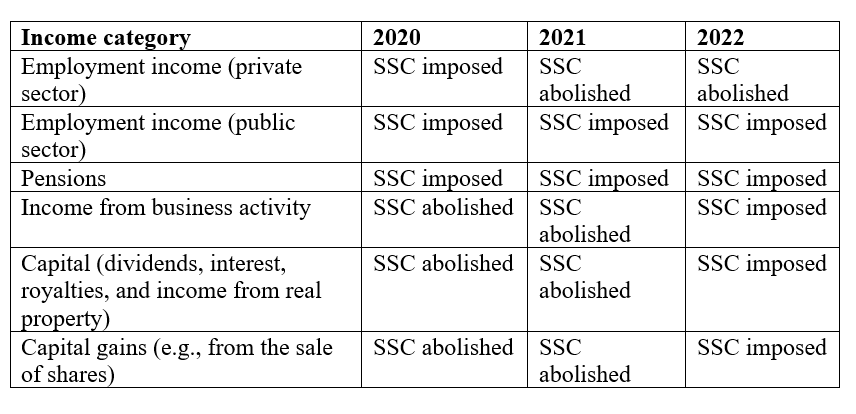

Greece Enacts Corporate Tax Rate Reduction Other Support Measures Mne Tax

States With Highest And Lowest Sales Tax Rates

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax By State Is Saas Taxable Taxjar

How High Are Capital Gains Taxes In Your State Tax Foundation

Chicago Il Cost Of Living Is Chicago Affordable Data

States With Highest And Lowest Sales Tax Rates

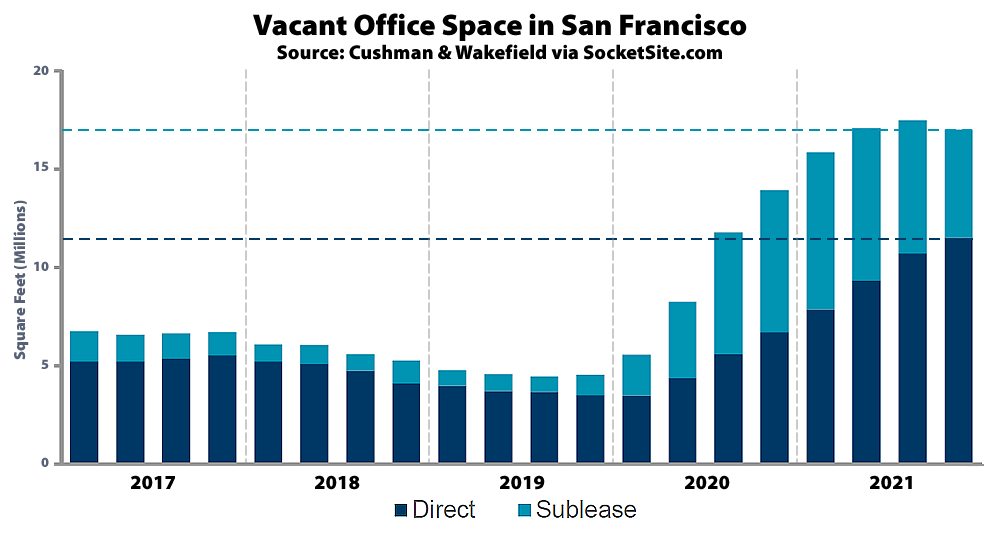

Office Vacancy Rate In San Francisco Inches Down But

Frequently Asked Questions City Of Redwood City

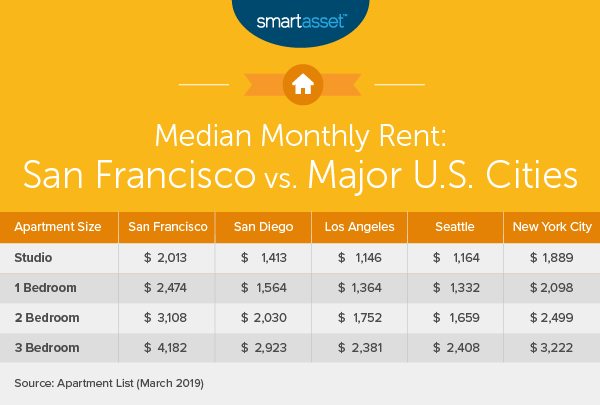

What Is The True Cost Of Living In San Francisco Smartasset

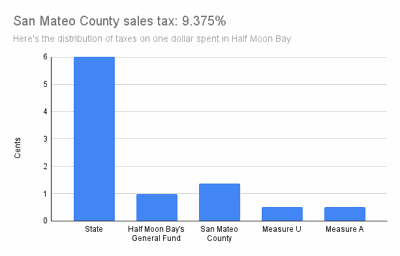

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

How Do State And Local Sales Taxes Work Tax Policy Center

Car Rentals In South San Francisco From 56 Day Search For Rental Cars On Kayak

Understanding Where California S Marijuana Tax Money Goes

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur