maryland earned income tax credit 2019

If your employer offers an adoption assistance program you can exclude up to 14440 from your income in 2021. MORE SUPPORT FOR UNEMPLOYED MARYLANDERS The RELIEF Act will repeal all state and local income taxes on unemployment benefits for tax years 2020 and 2021 helping people get more refunds during.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Find eligible income and information requirements on the Comptroller of Maryland website New Jersey.

. This is a result of House Bill 856 Acts of 2018 amending the Maryland earned income tax credit to allow an individual without a qualifying child to. The City of Canfield imposes a local tax of 10 on all income earned within the city. Help with Earned Income Tax Credit notices.

Indiana has a state income tax of 3230. The credit is reduced if your adjusted gross income AGI is more than 201010. Local earned income credit from Local Earned Income Credit Worksheet in Instruction 19.

Check this box if you are claiming the Maryland Earned Income Credit with a qualifying child. Total Maryland income tax local income tax and contributions Add lines 34 through 38. A document published by the Internal Revenue Service IRS that provides information on the earned income credit EIC available to individuals earning below a certain income.

You cant get the credit if you earn more than 241010. 31 to send you your W-2 form reporting your 2021. The tax is levied on both the net income and the business earned in the City of Canfield and on the wages salaries and other forms of compensation earned by.

January to March. MARYLAND TAX Check this box if you are claiming the Maryland Earned Income Credit COMPUTATION but do not qualify for the federal Earned Income Credit. Earned income tax credit from worksheet on page 8 of instructions.

The Earned Income Tax Credit - EIC or EITC - is a refundable tax credit for taxpayers who earn low or moderate incomes. The credit amount depends on your income. The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years.

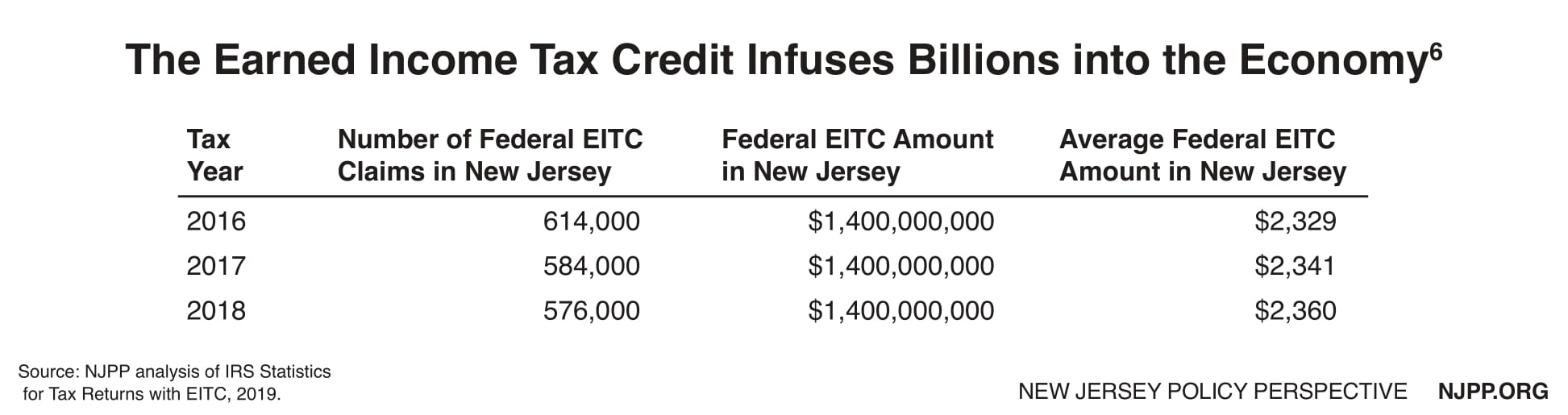

This credit is meant to supplement your earned income. For example in 2017 14 million families in California shared a total of 325 million in state credits bolstering the 68 billion they received in federal credits. Your employer has until Jan.

Most states will release updated tax forms between January and April. Deadline for employees who earned more than 20 in tip income in December to report this income to their employers on Form 4070. Unlike other states Maryland requires employers to submit EITC notices by December 31 2019.

Beaver Dam Wisconsin D. Income you have earned through working whether for yourself - self-employed - or for someone else. The current tax year is 2021 with tax returns due in April 2022.

Taxpayers to indicate they are claiming the Maryland Earned Income Credit but do not qualify for the federal Earned Income Credit. State earned income tax credits provide an additional benefit to the federal credit for low-income taxpayers by reducing their state income tax liability. Deadline to pay the fourth-quarter estimated tax payment for tax year 2021.

Learn more about taxable income. TAX YEAR 2019 RESIDENT INCOME TAX RETURN. Use Tax 00 00 00 00 00 00 00 00 44 I authorize the Director of Taxation or the Directors designee to discuss my return and enclosures with my preparer.

IRS Publication 596.

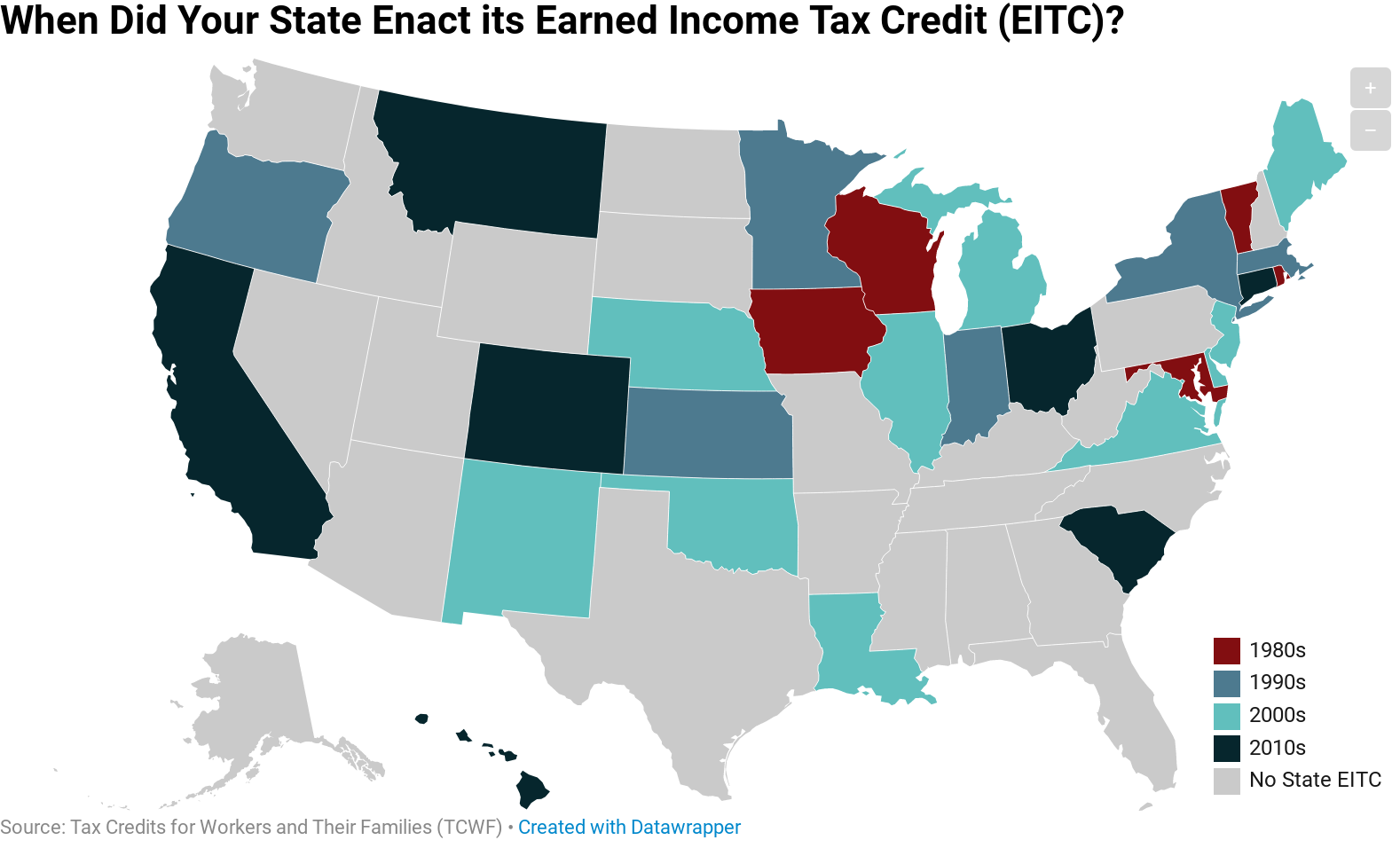

When Did Your State Enact Its Eitc Itep

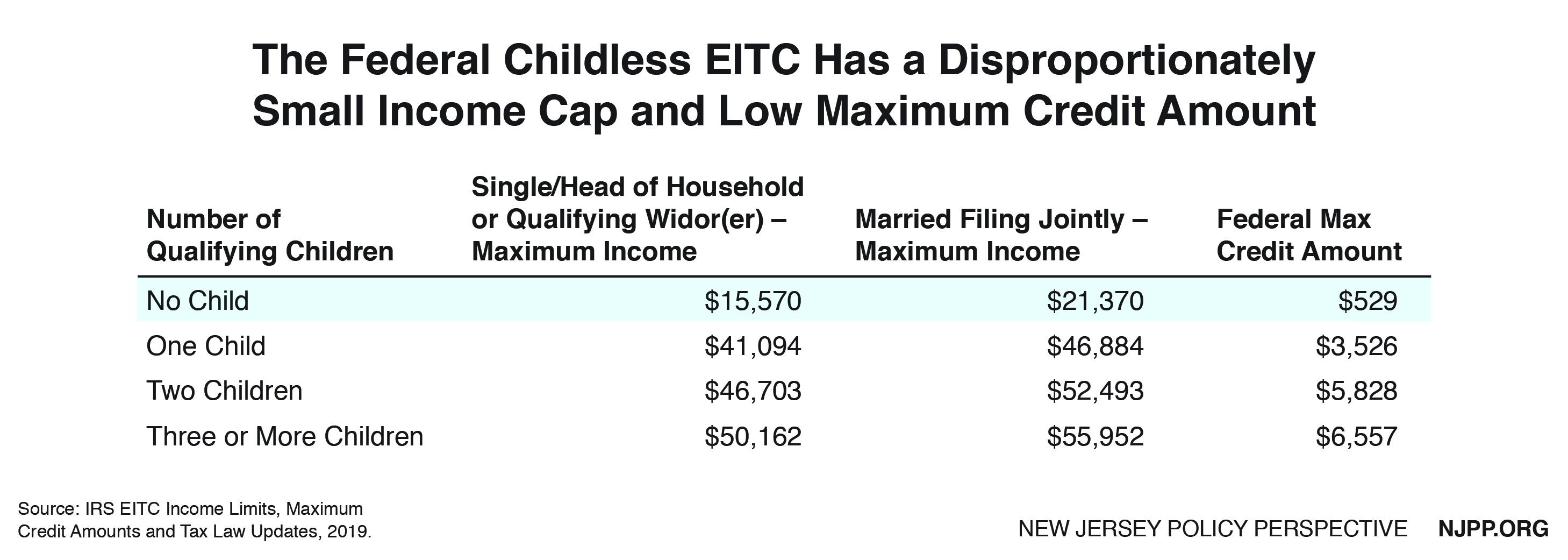

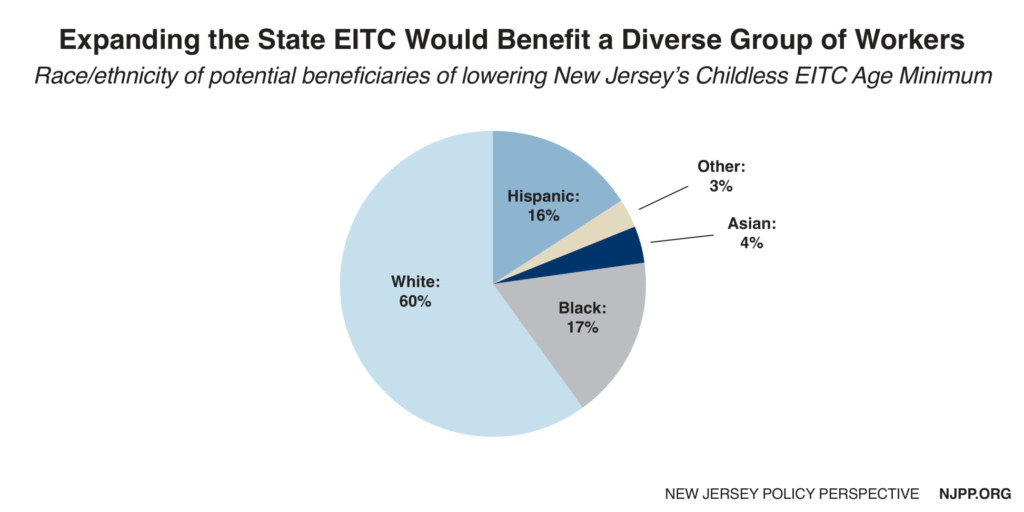

Prosperity For All Expanding The Earned Income Tax Credit For Childless Workers New Jersey Policy Perspective

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Summary Of Eitc Letters Notices H R Block

Filing Maryland State Taxes Things To Know Credit Karma Tax

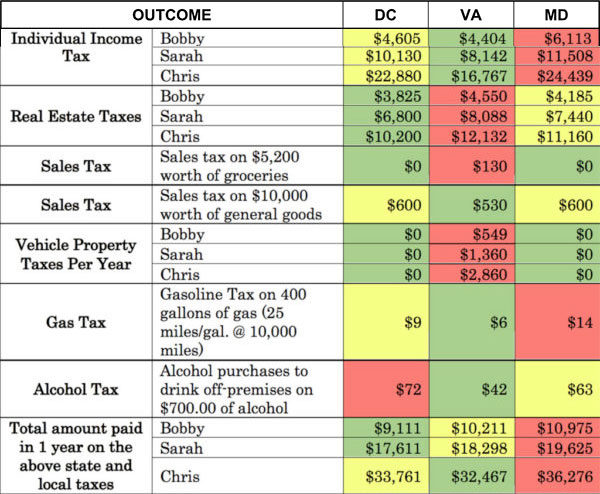

Ask Eli Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Arlnow Arlington Va Local News

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Earned Income Credit H R Block

Prosperity For All Expanding The Earned Income Tax Credit For Childless Workers New Jersey Policy Perspective

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

Table 1 From The Earned Income Tax Credit Eitc Percentage Of Total Tax Returns And Credit Amount By State Semantic Scholar

Prosperity For All Expanding The Earned Income Tax Credit For Childless Workers New Jersey Policy Perspective

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)