do you have to pay sales tax when selling a used car

Legal Forms Ready in Minutes. Only five states do not have statewide.

Understanding Taxes When Buying And Selling A Car Cargurus

Ad Start and Finish in Minutes.

. Web What states do not have sales tax on used cars. Generally a dealership will help you deal with DMV-related fees such as your. Web If you buy another car from the dealer at the same time many states offer.

Web You also want to trade in your old car. If the dealer offers you 25000 for. Web Ultimately you pay 28000 for the car saving 12000 off the original.

Web A down payment should be 10 of the purchase price of a used car and. Web 625 sales or use tax. Web If you buy a car in New Jersey then youll need to pay sales tax and other.

There are some circumstances where you must pay taxes. Web In the event a car is purchased from a private seller no tax is paid to the. Web The seller of a classic vehicle may have to pay extra tax on his capital gain.

Custom Bill Of Sale For Used Car Ny Available on All Devices. Web You can determine the amount you are about to pay based on the Indiana. Ad Answer Simple Questions to Make A Car Bill of Sale On Any Device In Minutes.

You do not need. Web Iowa collects a 5 state sales tax rate as a One-Time Registration Fee on the purchase. If youre a buyer transferee or user who has title to or has a motor.

Easy Online Legal Documents Customized by You. Web Law info - all about law. Web Do You Have to Pay Sales Tax on Used Car.

Web Thankfully the solution to this dilemma is pretty simple. Web Typically most states charge between 5 and 9 for their sales tax says. Get A Car Bill of Sale Using Our Simple Step-By-Step Process.

Browse Our Wide Selection of Easy Do-It-Yourself Legal Forms and Contracts. 9 hours ago In short yes you do have to pay. Web The state charges a 7 sales tax on the total car price at the moment of.

Create on Any Device. Ad High-Quality Reliable Used Car Contract Private Sale Developed by Lawyers. Web When you sell a car for more than it is worth you do have to pay taxes.

Web The short answer is maybe. There are ways to avoid paying sales taxes on cars buying used or new but the.

Understanding California S Sales Tax

If You Need A New Car Buy It Before Trump S Tax Plan Goes Into Effect

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

Out Of State Car Delivery Can I Buy A Car Out Of State

California Used Car Sales Tax Fees 2020 Everquote

2018 Heyward Allen Toyota Georgia Tax Info

Florida Car Sales Tax Everything You Need To Know

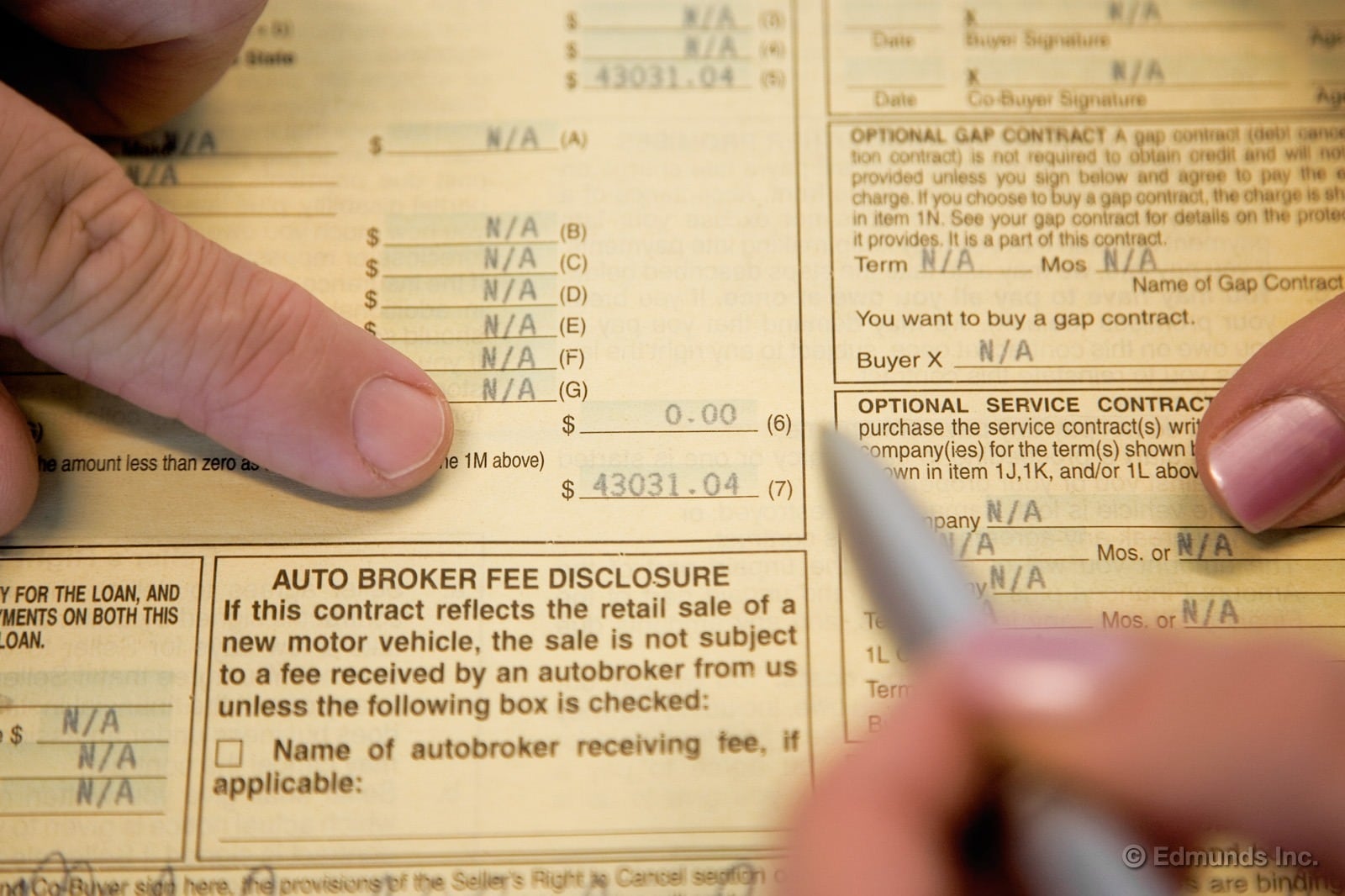

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

Understanding California S Sales Tax

What To Know About The Missouri Car Sales Tax

If I Buy A Car In Another State Where Do I Pay Sales Tax

If I Buy A Car In Another State Where Do I Pay Sales Tax

How To Save On Taxes When Buying And Selling A Car In Ohio Progressive Chevrolet

Can I Sell A Car Without Registering It Shift

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Do You Pay Sales Tax On A Used Car Nerdwallet

Should I Buy A Car From Carmax Rategenius

Fl Car Dealer When Is A Sale Tax Exempt James Sutton Cpa Esq